United Airlines has announced a $15 million investment in Svante, a Canadian company specialising in carbon capture and removal technology. Svante’s proprietary technology uses structured absorbent beds, or filters, to capture CO2 sucked from the atmosphere or from industrial emission sources, for conversion into fuel or removal and storage. The investment, part of Svante’s Series E financing round, was made by UAV Sustainable Flight Fund, a division recently established by United to support companies focused on SAF research, technology and production. United is committed to eliminating its greenhouse gas emissions by 2050 without the use of conventional carbon offsets, and has invested in a range of emerging SAF producers and zero-emission aircraft and engine concepts. It has also invested in the future production of more than 3 billion gallons of SAF – more, it claims, than any other airline – using a variety of feedstocks and production processes.

Svante, named after Swedish scientist Svante Arrhenuis, who is credited as one of the first to identify the correlation between increased CO2 in the atmosphere and warming of the Earth’s surface, is a specialist in second-generation sorbent-based carbon capture and removal, through which structured absorbent beds, or filters, are used to capture atmospheric CO2, called direct air capture (DAC), or 95% of CO2 emissions from industrial flue gas, which is referred to as point-source carbon capture.

The investment by United is part of Svante’s Series E financing round, which will be used to fund and support its commercial-scale filter production facility in Vancouver. Among the company’s partners is Dimensional Energy, a CO2-to-jet fuel company in which United Airlines Ventures invested last year.

“Carbon capture technology has the potential to be a critical solution in the fight to stop climate change and has the added benefit of helping us scale the production of SAF,” said Scott Kirby, United’s CEO. “There’s no question that this carbon utilisation is in its infancy today but as a leader in sustainable flying, we must help build the foundation to deploy this technology of the future as expediently as possible. We’re building on that approach by investing in both companies that can capture CO2 and others that can turn it into fuel. United’s investment in Svante reflects our dedication to making sustainable travel a reality.”

Svante CEO Claude Letourneau responded: “The airline industry has a huge opportunity to make a big impact on global decarbonisation, battling climate change through the transition to sustainable aviation fuels and other innovative technologies that will help the world achieve net zero. We are pleased to have the support of United Airlines as one of our world-class investors. Their investment in companies like ours will aid in accelerating the commercialisation of carbon capture and removal technology.”

Jason Salfi, CEO of Dimensional Energy, said his company and Svante were already working together to design integrated systems for CO2 conversion to SAF. “There is enough CO2 in the atmosphere and in industrial process emissions to provide all of the carbon necessary for the fuels and products people use every day, now and into the future,” he said. “Svante provides the first step towards a circular carbon economy.”

Warned Letourneau: “Without carbon capture, utilisation and storage, the world will not reach net zero by mid-century,” he warned. “To effectively capture the CO2 currently being emitted into the atmosphere, the world needs to have 10,000 capture plants running over the next 30 years, or two plants a week in the next decade, at a cost of approximately $250 million per plant.”

United’s investment in Svante is representative of a growing number of deals in North America enabled by the Biden Administration’s 2022 Inflation Reduction Act, a major initiative which includes a blended tax credit for SAF infrastructure and supply as well as incentives for clean energy and carbon capture. When the legislation was announced, Letourneau described it as “a monumental bill that truly demonstrates America’s commitment to climate action, and a way to monetise CO2 emissions to develop a viable carbon management industry. Its impact will drive the investment required to bring mass commercial-scale projects to financial investment decision.”

Founded in 2007, Svante currently has four pilot plants in Canada and California and its Series E fundraising round, led by Chevron New Energies, closed at $318 million.

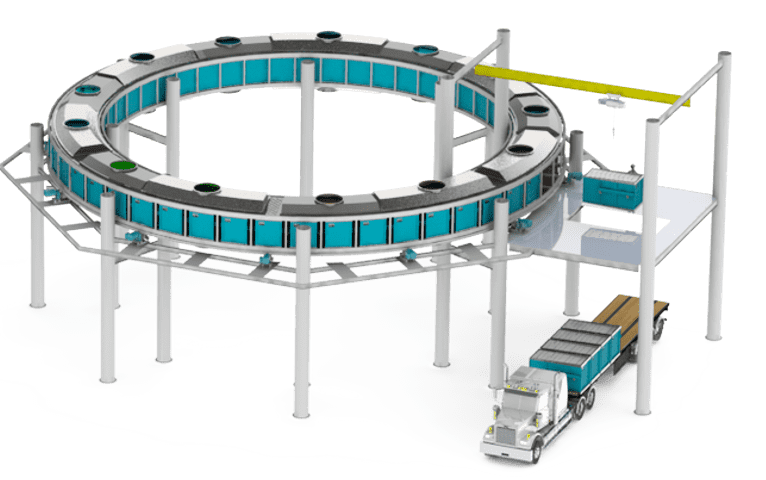

Graphic: Svante’s technology employs structured absorbent beds, known as filters, which can capture 95% of CO2 emissions from industrial sites as well as CO2 that’s already in the air. Once the CO2 is captured, it is concentrated and can be used in the creation of SAF or other products. It can also be safely transported and stored underground.

More News & Features

Carbon reduction consultancy Watershed facilitates SAF certificate deals through SABA

IAG continues to go big on e-SAF as it inks 10-year offtake agreement with Infinium

US on the pathway to achieving its 2030 SAF Grand Challenge target, says DOE report

Infinium and Twelve raise a total of up to $1.7 billion towards eSAF production

British Airways announces major investment in carbon removal credits through partner CUR8

AIR COMPANY raises $69 million to advance its industrial CO2-to-SAF process